21/12/2023 - 04:26

GTD order

A good-till-date order (GTD order) is a conditional order that allows the customer to select the trading session and date to send the order to the Stock exchange.

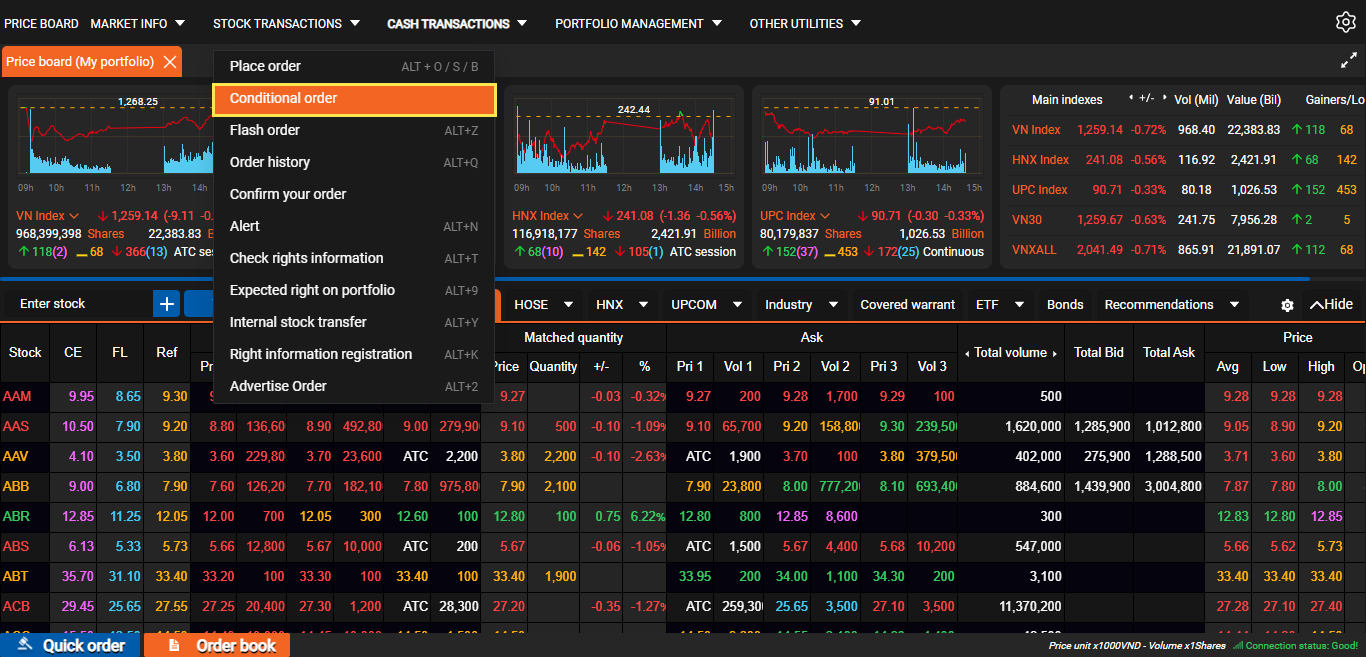

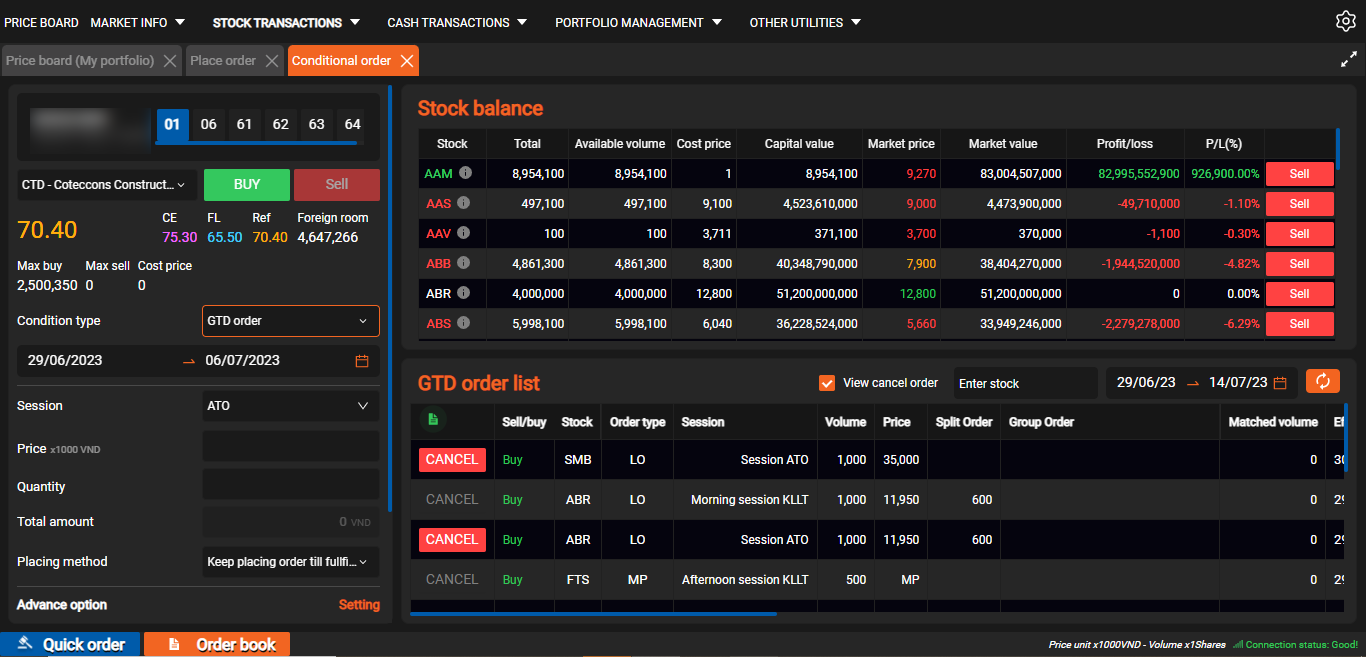

- To access the “Place GTD order” screen, you need to hover your mouse over the “Stock transactions” section of the main menu bar and click “Conditional Order”

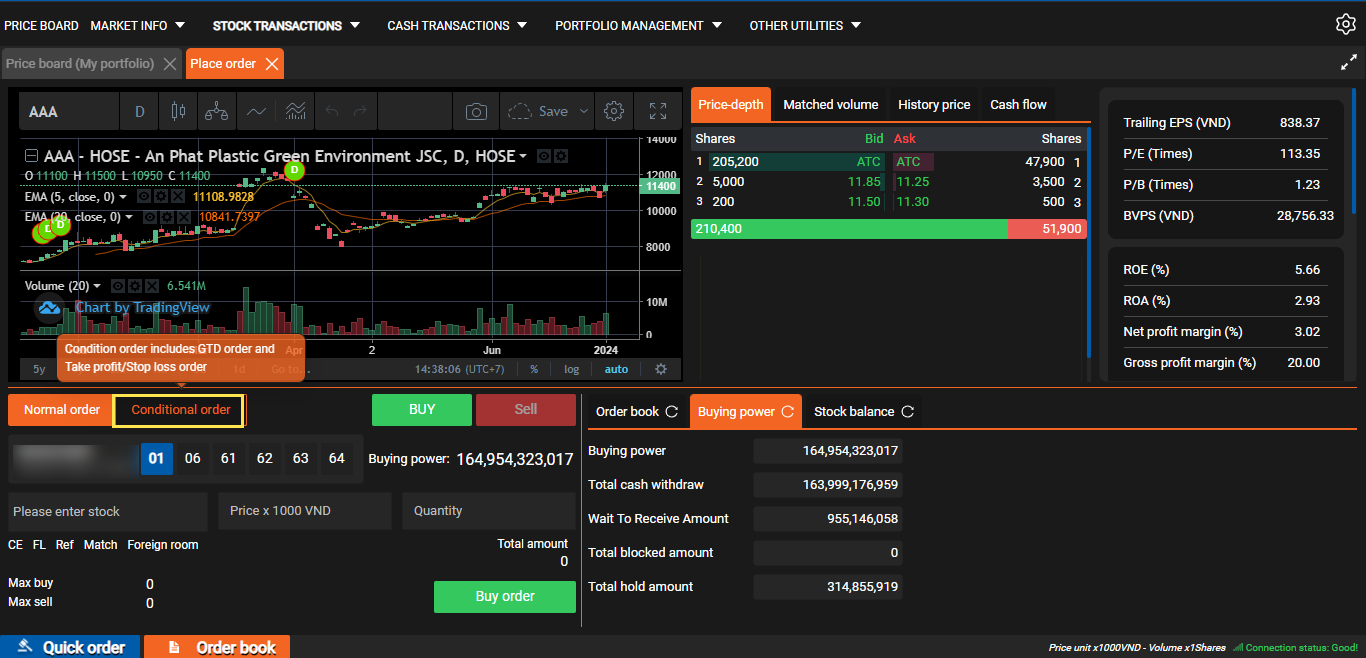

- Or, at the Normal order screen, select the Conditional Orders tab

- The system will go to the Conditional order screen. Here, you select GTD Order to proceed with placing the order

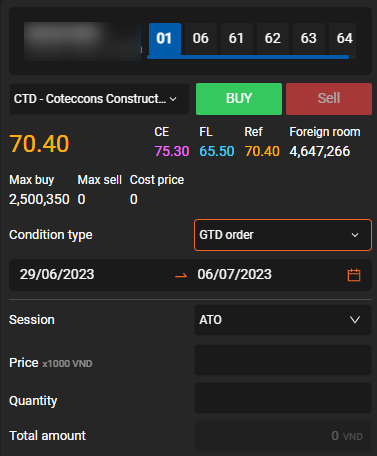

- You can choose the sub-account to buy/sell securities by clicking on each sub-account below. Enter the ticker symbol to buy/sell, when entering any ticker, the system will automatically display information related to the ticker symbol.

- You can select GTD Order Validity, trading session, then enter the price and volume to buy/sell the stock.

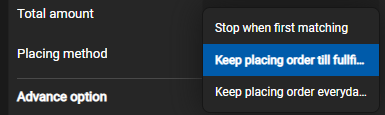

- Customer selects the placing method, the system will default to choose Keep placing order till fullfilling the setting quantity:

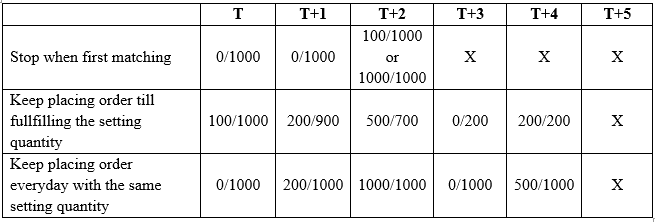

+ Stop when first matching: the order will expire when the order partially fills or fills the full volume set

+ Keep placing order till fullfilling the setting quantity: the order will expire when the order is filled with the full set volume.

+ Keep placing order everyday with the same setting quantity: during the validity period, the system will push orders with the volume set to the Stock exchange every day.

For example: Customer wants to place an order to sell GTD code ACB, volume 1000, Morning Continuous Order session, valid from day T to day T+4. Below is a table of order execution volume/set volume for customer in validity dates:

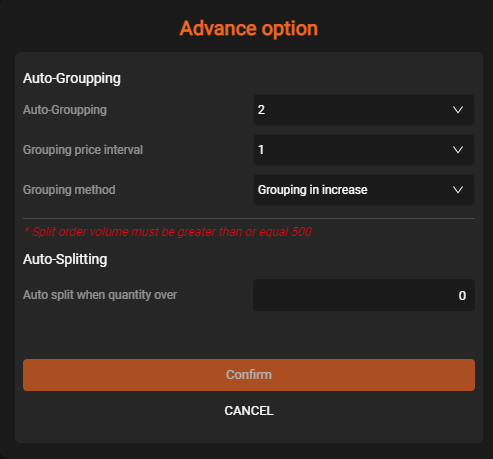

- Customers can choose advanced configuration for Orders (Default system OFF function, customer press ON to use):

+ Auto-splitting: when set quantity is more than n shares, the order will be divided into sub-orders corresponding to the number set.

For example, customers want to place an order to sell GTD code ACB, volume 1000, price 20,300 and select Auto-splitting when volume exceeds 600 shares. At the setting session, the system will push to the 2 ACB sell orders priced at 20,300 with a volume of 600-400 shares respectively.

+ Auto-grouping: the system will push the order group corresponding to the number of orders/tick size set.

For example: Customer wants to place an order to sell GTD code ACB, volume 1000, price 20,300 and select Auto-grouping 2 orders 1 tick size from the ascending price. At the setting session, the system will push to the Stock Exchange 2 ACB sell orders with a volume of 1000 and prices of 20,300 – 20,350 respectively

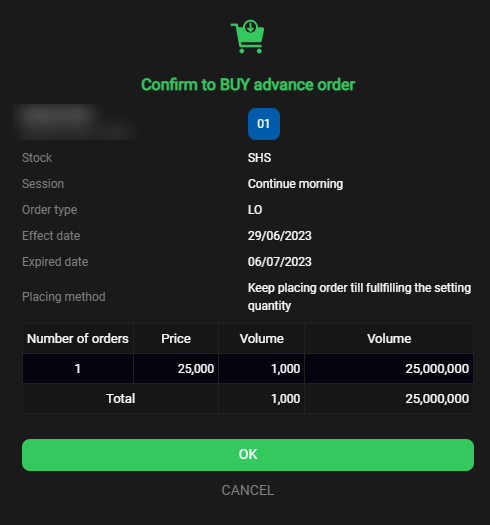

- After entering all information, the customer proceeds to place an order by clicking the button “Place a buy order” or “Place a sell order”, the system will display an order confirmation message, you click “OK” to proceed with placing the order and go to the next step or select “Cancel” to close the notification and cancel the operation

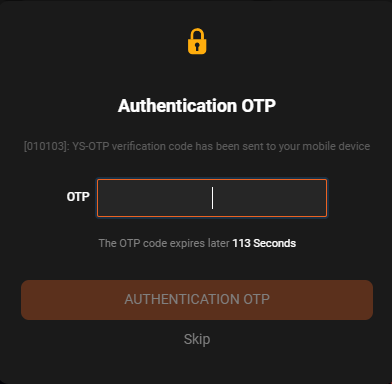

- After clicking “OK”, the system will open a new notification and ask you to enter the OTP code to confirm the buy/sell order (In case the customer has not entered the OTP at the login screen). Note: OTP placing order will be recorded during the login session.

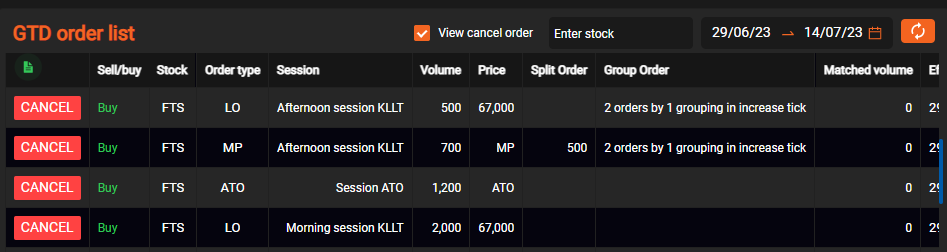

- Customers can track GTD orders at the GTD Order Book. Customers can also search for orders using the search function by code or time filter.